The Forced Labor Enforcement Task Force (FLETF) recently announced significant updates to the enforcement of the Uyghur Forced Labor Prevention Act (UFLPA). FLETF, led by the Department of Homeland Security, has expanded its efforts to keep goods produced with forced labor—particularly from China’s Xinjiang Uyghur Autonomous Region—out of the U.S. market. UFLPA was enacted in December 2021 to combat China’s systemic use of forced labor, particularly targeting Uyghur and other ethnic minorities.

Expanded Entity List and Product Coverage

Since the last update, FLETF has added 78 new entities to the UFLPA Entity List, bringing the total number of entities to 144. These entities are believed to be involved in forced labor or to benefit from government labor schemes in Xinjiang. The list now covers a wide range of sectors, including textiles, apparel, electronics, agricultural products, batteries, and more. Notably, technical corrections have been made to clarify entity names and aliases, ensuring more precise enforcement.

Goods produced wholly or in part by these listed entities are subject to a “rebuttable presumption” that they are made with forced labor and are therefore prohibited from entering the U.S. unless importers can provide clear evidence to the contrary, as required by U.S. Customs and Border Protection (CBP).

New High-Priority Sectors for Enforcement

FLETF designates a sector as high-priority for enforcement when sufficient information indicates at least one of the following is met:

- credible evidence, from sources such as civil society and academic reporting, or multiple entities in the sector having a high risk of utilizing or facilitating forced labor, including through poverty alleviation and labor transfer programs involving Uyghurs or other persecuted groups from Xinjiang;

- The sector is targeted by Chinese national, regional, or related government entities for investment and/or expansion, often through official plans or initiatives; or

- Xinjiang-based production of the sector’s goods constitutes 15% or more of total Chinese production or at least 10% of global production.

Using these criteria, FLETF identified five new high-priority sectors for enforcement:

- Caustic soda

- Copper

- Jujubes (red dates)

- Lithium

- Steel

Caustic Soda

China is the world’s top producer of caustic soda, with Xinjiang as the fourth largest region of production, accounting for around 16% of Chinese total production, exceeding FLETF’s 15% threshold. Multiple Xinjiang-based entities in the caustic soda sector are implicated in forced labor schemes, with documented evidence of entities working with the Xinjiang government to recruit and transfer forced labor. Another producing entity in the region was identified as participating in state-sponsored forced labor and cultural assimilation effort. These entities were included in the UFLPA entity list.

Copper

Copper is a main focus of multiple Chinese national and provincial five-year and sector development plans, including recent explicit designations as a target sector for investment and expansion by central, regional, and Xinjiang Production and Construction Corporation authorities. There have been credible reports, including a major academic/NGO report titled, ‘Driving Force’, identifying at least 15 Xinjiang-based mining, smelting, or processing companies as operating with or participating in state-sponsored forced labor programs.

Jujubes (Red Dates)

China is the world’s leader in jujube production with the Xinjiang-Uyghur Autonomous Region accounting for 50% of their total, Xinjiang itself representing 20% of global jujube production. Additionally, the Xinjiang Production and Construction Corps holds a majority stake in at least 13 jujube companies, making up more than 25% of Chinese national output.

Jujube orchards are frequently planted in the same fields as cotton, a sector already identified as extremely high risk by FLETF. Finally, NGO reporting has directly linked forced labor to red date production in the Xinjiang region.

Lithium

Chinese lithium production has seen substantial growth in recent years, with the government identifying Xinjiang as a key area for lithium resource development and battery manufacturing projects. China’s share of global lithium reserves rose 10% to 16.5% with Xinjiang named as a location for new major deposits.

Reports cited in the UFLPA update identify at least 12 Xinjiang companies in the lithium value chain as participants in labor transfer schemes involving Uyghurs or other persecuted minorities. FLETF also cites companies directly linked to forced labor, with two currently present on the UFLPA Entity List.

Steel

Steel has been a priority for China and the Xinjiang Production and Construction Corps since at least 2016, with planning documents for investment, technical upgrades, and expansion, especially to supply strategically important downstream sectors (e.g. automotive, shipbuilding) in existence. There are multiple steel producing companies on the UFLPA entity list, making supply chains in this region an elevated risk for forced labor using FLETF’s criteria.

Steel is identified in multiple official government plans as essential to local economic development in Xinjiang and is a target for further resource exploitation, increasing state control and thus forced labor risk.

The addition of these sectors expands the list which already includes: aluminum, apparel, cotton and cotton products, polyvinyl chloride (PVC), seafood, silica-based products (including polysilicon), and tomatoes and downstream products. The original sectors were chosen based on similar criteria to the new sectors: credible evidence of forced labor risks and their strategic importance in Xinjiang’s government planning.

Increased Enforcement

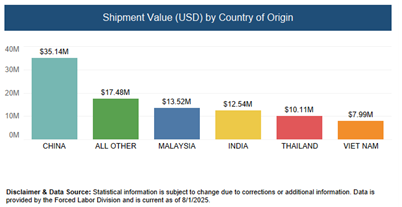

Since UFLPA went into effect, CBP has detained over 16,000 shipments valued at nearly $3.7 billion for review, ensuring goods tied to forced labor do not enter U.S. commerce. Since the beginning of 2025, 6,613 shipments with a value of almost $100 million have been detained with the majority coming from China.

CBP UFLPA Enforcement Statistics: Shipment Value by Country, FY 2025

Conclusion

The latest UFLPA enforcement updates underscore the U.S. government’s continued focus on combatting forced labor and protecting compliant businesses from unfair competition. The expansion of the Entity List and high-risk sectors reinforces FLETF enforcement priorities in the coming months. Importers are advised to take proactive steps now to ensure compliance and avoid disruptions at U.S. ports.

[View source.]