US IPO markets entered 2025 well positioned for a promising year as stabilizing interest rates, a business-friendly US administration and the pressing need for private equity firms to exit portfolio companies laid the foundation for a favorable IPO environment, but uncertainty regarding US tariffs and retaliatory actions by other nations, and continuing market volatility have weighed on early offerings

US IPOs showed steady gains in 2024 as inflation stabilized and interest rates edged downward in the fourth quarter, putting the US stock market flotations in a strong position at the start of 2025.

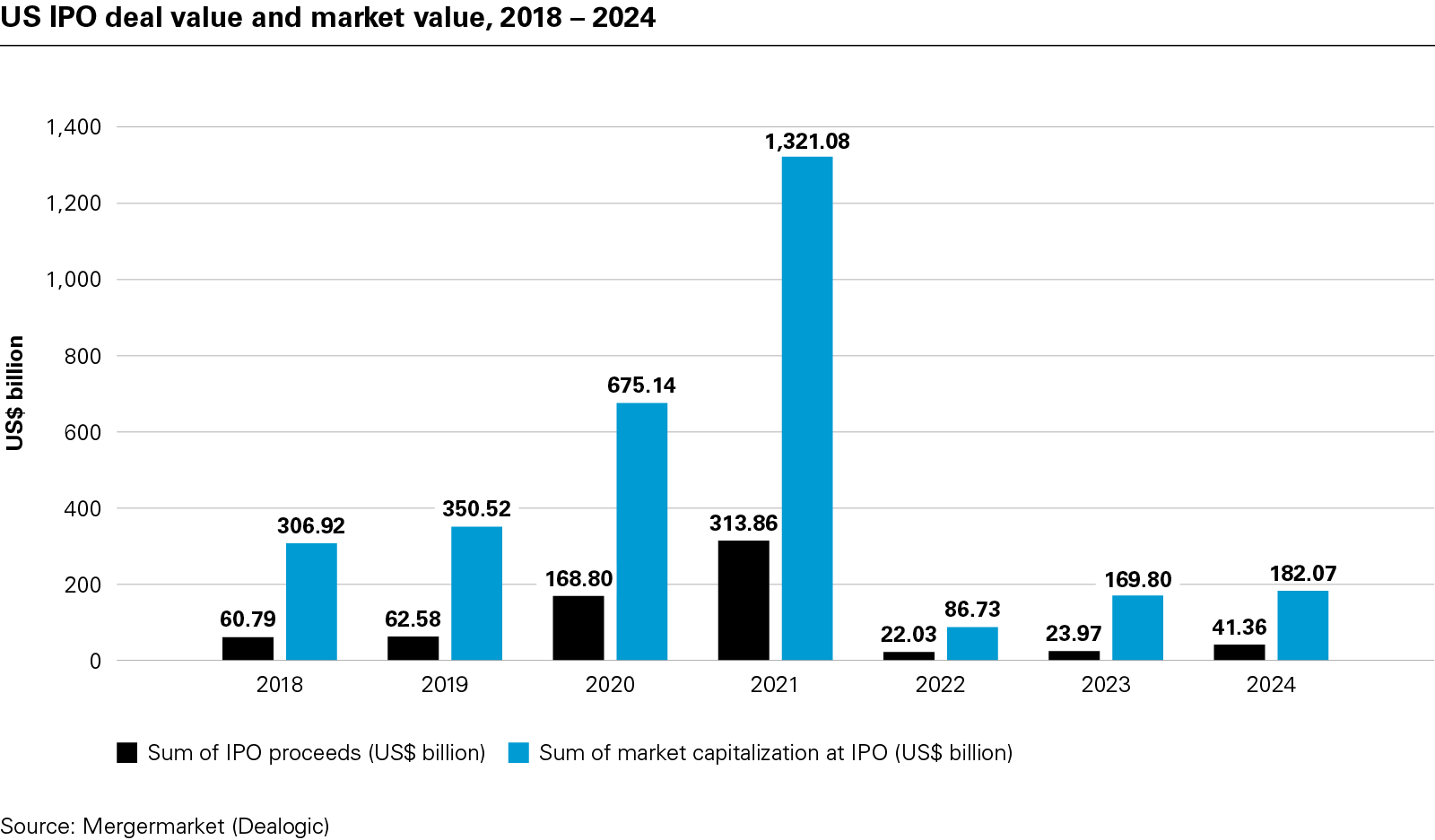

For the second year in a row, US IPO proceeds (incl. SPACs) increased, reaching US$41.36 billion in 2024, a 75 percent increase compared to 2023 levels, although still significantly below pre-pandemic amounts.

View full image: US IPO deal value and market value, 2018 – 2024 (PDF)

View full image: US IPO deal value and market value, 2018 – 2024 (PDF)

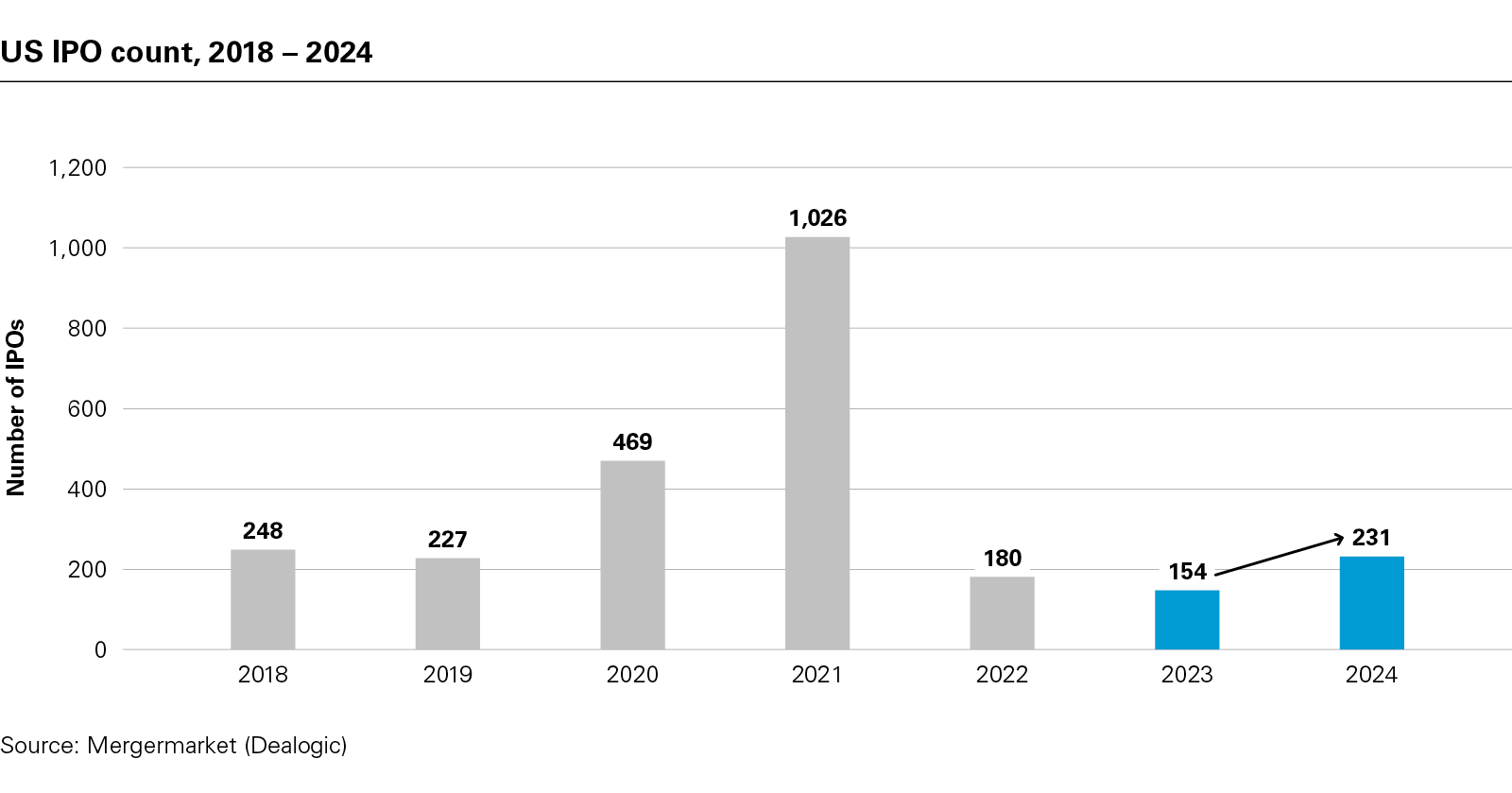

View full image: US IPO count, 2018 – 2024 (PDF)

View full image: US IPO count, 2018 – 2024 (PDF)

The US continued to lead the world for IPO proceeds (nearly doubling the levels recorded in India, the next-largest jurisdiction by IPO proceeds) and remained the single largest market for cross-border listings, underscoring the depth and flexibility of the US capital markets.

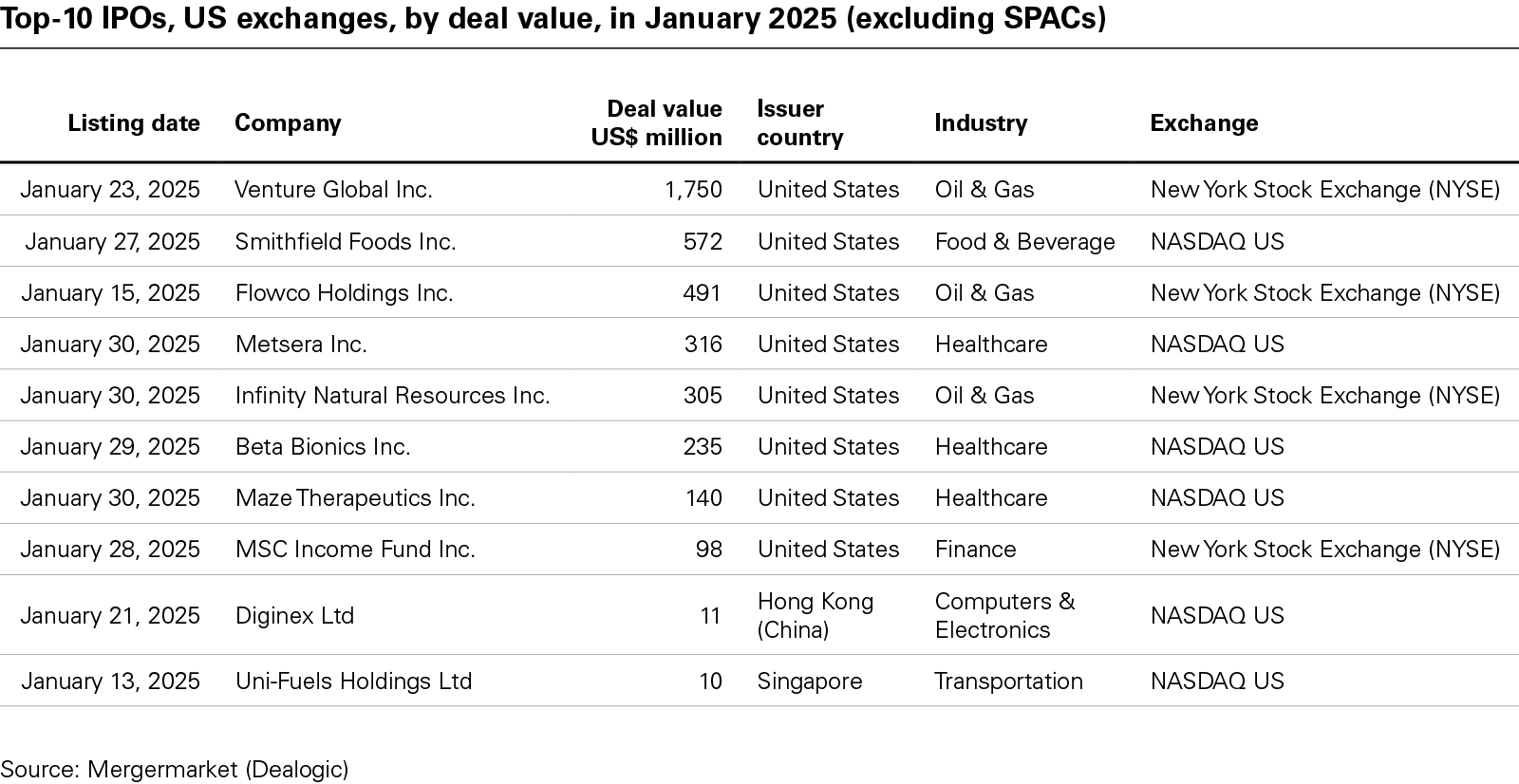

The positive impact of an improving US IPO market in 2024 has carried into 2025. IPO figures for January 2025 compare favorably with January 2024, with US IPOs up from 17 to 29, and US IPO deal value rising from US$3.45 billion to US$5.1 billion.

The pipeline for additional IPOs is encouraging. As of March 5, 2025, there were 57 pending F-1 filings (IPO registration statements filed with the US Securities and Exchange Commission (SEC) by foreign issuers) and 134 pending S-1 filings (SEC registration statements filed with the SEC by US domestic issuers). Other high-profile companies that are widely discussed as potentially proceeding with US listings in 2025 include video game app Discord, while buy-now-pay-later fintech Klarna filed for a US IPO in the middle of March, in a deal that could value the company at up to US$15 billion.

The business-friendly approach of the new US administration, which is expected to reduce taxes, roll back regulations and support additional investment in areas such as cryptocurrency, will encourage IPO activity. The nomination of Paul Atkins, a crypto supporter who favors deregulation, for chair of the SEC, and the appointment of SEC Commissioner Mark Uyeda (who is in favor of opening up private markets to more investors), as acting SEC chair, have clearly signaled that the new US administration will take a lighter touch approach to market regulation.

The US administration is also expected to offer strong support for the technology and artificial intelligence (AI) industries given the endorsement of Stargate, a US$100 billion joint venture between SoftBank, OpenAI and Oracle, set up to finance AI infrastructure development.

Meanwhile, the administration's recent energy policy aims to incentivize traditional energy sources while reducing incentives for renewable energy, with the goal of lowering energy prices by increasing supply. As a result, the first major IPO under the new administration was liquified natural gas exporter Venture Global, which is also the largest oil & gas IPO within the past decade. Generally, the new energy policies are driving natural gas prices and related stocks higher, although Venture Global has traded below its IPO price.

However, the pro-business stance of the new administration has been counter-balanced by uncertainty around tariffs on imports from Canada, Mexico and China, the US's three largest trading partners.

The impact of general global import taxes targeting products such as foreign automobiles, semiconductors and pharmaceutical products on economic growth has weighed on some offerings in early 2025 and will remain on the radar for prospective issuers.

Additionally, the US administration's effort to limit illegal immigration and deport undocumented immigrants may reduce the labor supply and, as a result, could have an impact on inflation and disrupt the labor force.

Overall, the new US administration is seen as a net positive for capital markets activity. While US IPO proceeds are still lagging pre-pandemic numbers, there is measured optimism that a more settled interest rate outlook and business-friendly US administration will support healthy IPO activity in 2025.

View full image: Top-10 IPOs, US exchanges, by deal value, in January 2025 (excluding SPACs) (PDF)

View full image: Top-10 IPOs, US exchanges, by deal value, in January 2025 (excluding SPACs) (PDF)

Solid aftermarket performance comforts investors

For investors, the solid aftermarket performance of new IPOs is a key determinant of whether to back new flotations or make allocations to businesses already listed. The strong returns delivered by 2024 IPOs bode well for the year ahead.

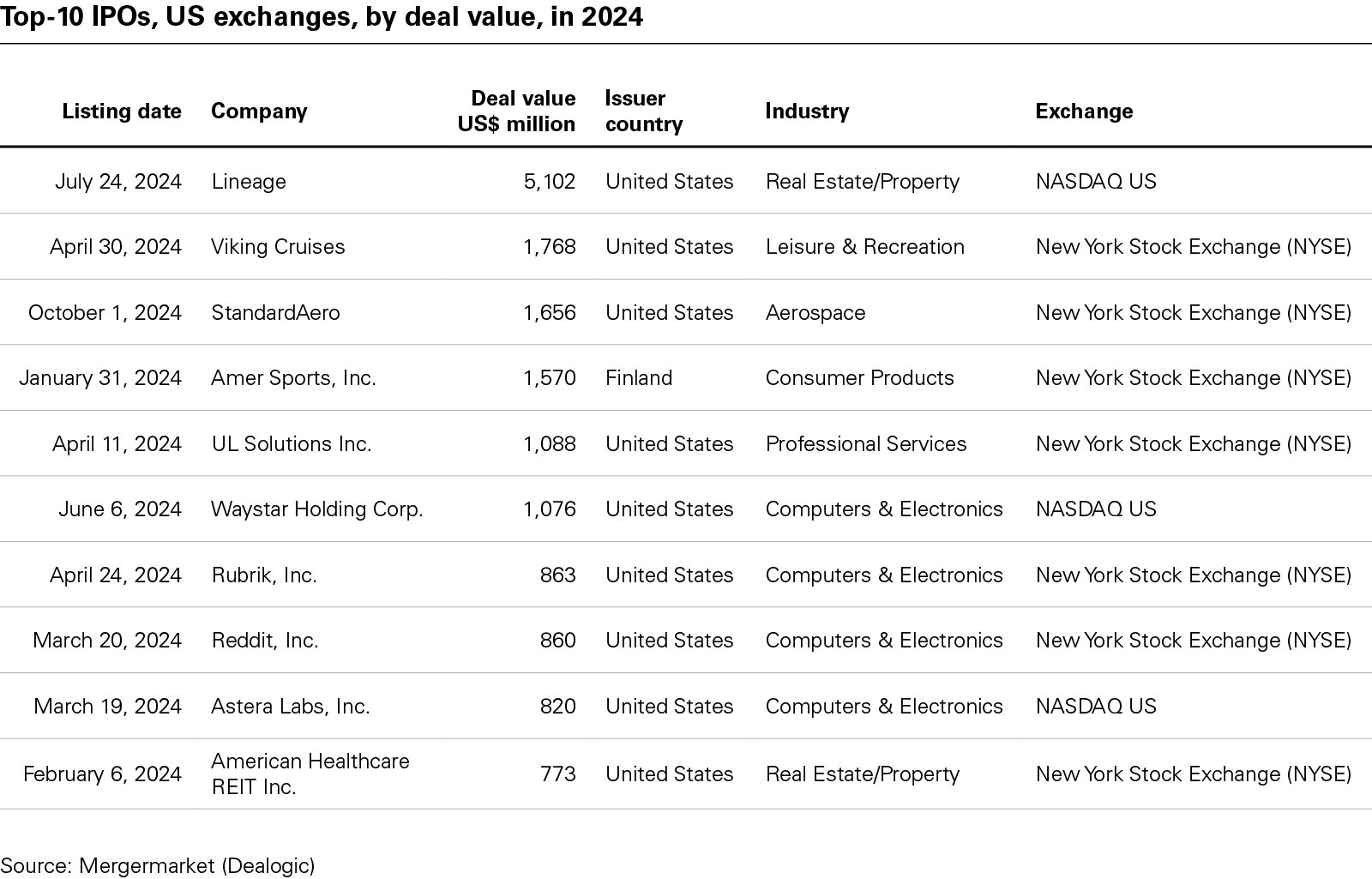

Nine of the ten largest IPOs in 2024 ended the year trading above their pre-listing prices, with half—most notably Reddit—achieving triple-digit gains, according to the Financial Times.

View full image: Top-10 IPOs, US exchanges, by deal value, in 2024 (PDF)

View full image: Top-10 IPOs, US exchanges, by deal value, in 2024 (PDF)

However, the performance of the wider stock market will influence the post-IPO trading of newly listed companies, and it remains to be seen how equity markets will react to the imposition of tariffs throughout 2025. Investors have become more sensitive to concentration risk after the launch of a new AI-powered chatbot by Chinese company DeepSeek, which impacted the stock market valuations of major US tech giants.

Private equity push

IPO stakeholders will be hoping for a meaningful increase in private equity-backed portfolio company listings, as buyout firm managers—who have held onto assets during a period of uncertainty and deal valuation disruption due to interest rate hikes—take advantage of a more stable backdrop to clear backlogs of unsold portfolio companies.

According to McKinsey, the number of unsold private equity-backed portfolio companies is now at an all-time high.

After sitting tight, private equity managers will be eager to start harvesting returns, with IPOs one of the main routes to liquidity.

US markets have already seen an uptick in private equity-backed IPOs during the past 12 months. EY figures show that sponsor-backed IPOs have accounted for close to 30 percent of the listings on US exchanges in 2024, almost double the 17 percent market share posted in 2023. Notable sponsor-backed listings in 2025 to date include Thoma Bravo–backed enterprise security company SailPoint's US$1.4 billion IPO in February.

Private equity portfolio company listings have the potential to increase again in 2025, with private equity-backed software company Genesys and medical devices group Medline among a cluster of sponsor portfolio companies that have already filed paperwork with regulators ahead of potential IPOs.

For companies seeking capital, IPOs are also becoming more attractive compared to other options such as private credit. Equity capital is more flexible than private credit, which has become more expensive due to rising interest rates and has proven to be more challenging to restructure. Higher interest rates on private credit loans—compared to banks loans—can also intensify risk. Thus, in the current environment, equity capital raised through an IPO can be more attractive.

SPACs are back

Special purpose acquisition company (SPAC) IPOs are also on track for a more positive 2025. There were eight SPAC IPOs in the US in January 2025, securing proceeds of US$1.13 billion. In January 2024, by contrast, only one SPAC IPO progressed, securing proceeds of just US$58 million.

The SPAC space boomed in 2021 at the peak of the market, but subsequently fell sharply because of mixed performance and the impact of SEC regulation.

SPAC volumes are highly unlikely to reach the peak levels observed prior to the increasing interest rate cycles, but with a smaller, more select group of SPACS coming to the market, activity levels are poised to improve compared to 2023 and 2024. The US$287.5 million IPO of K&F Growth Acquisition Corp. II, a SPAC that will target a business combination in the experiential entertainment industry, in February, was one of a number of SPAC IPOs that set the scene for further SPAC listings in the year ahead.

Meanwhile, the de-SPAC market (where companies obtain a public listing through a business combination deal with a SPAC rather than through a direct IPO) have also proved to be an appealing route to capital formation for companies.

De-SPAC deals provide a longer and more flexible public marketing period for price discovery, can be structured to include earn-outs to bridge valuation gaps, and can be structured to provide capital certainty through a PIPE or non-redemption agreements, which are some of the attributes that have been proven to be attractive through recent macroeconomic uncertainty.

Like SPAC IPOs, de-SPAC deal volumes have dropped from the peak of the market. There were 44 de-SPAC deals involving US target companies in 2024, generating combined deal value of US$23.83 billion. Although down from 2023 figures (80 de-SPAC deals valued at US$27.53 billion), 2024 numbers still represent meaningful levels of deal flow and show that taking a company to a listing with a de-SPAC deal remains a viable pathway to public markets.

Indeed, de-SPAC deals led by US-listed SPACs have started the year with four deals for a combined deal value of US$654.82 billion proceeding in January 2025. The US$949 million de-SPAC transaction announced in February by Helix Acquisition Corp. and BridgeBio Oncology Therapeutics, which included a US$260 million PIPE (representing committed capital), was a particularly positive sign in the market.

Quality will matter

For all IPO candidates, asset quality will be key. Investors have the appetite to support new stock market flotations, but will focus allocations on high-quality businesses with proven track records and current or near-term profitability.

Investors will be reluctant to back IPOs without credible, long-term growth stories. Marginal deals—where an IPO serves as a deleveraging play or involves a growth company yet to deliver a proven track record of consistent profitability or demonstrate a path to near-term profitability—will be challenging to push forward, even in an improving market.

With US IPO activity set to build on the progress it made in 2024, listings of high- quality companies will be the key driver for sustaining the US IPO recovery.

[View source.]